capital gains tax canada calculator

Ad Calculate capital gains tax and compare investment scenarios with our tax tools. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

Calculator For Determining The Adjusted Cost Base Of Etfs Mutual Funds Reits In Canada There Are Free And Pre Capital Gain Financial Fitness Investing Money

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

. Since its more than your ACB you have a capital gain. You realize a capital gain if you sell a capital asset and the proceeds of the sale exceed the adjusted cost base. Discover Helpful Information And Resources On Taxes From AARP.

The things you need to know to calculate your gain or loss like the inclusion rate adjusted cost base ACB and proceeds of disposition. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Do not include any capital gains or losses in your business or.

How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province. The Canadian Monthly Capital Gains Tax Calculator is updated for the 202223 tax year. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Ad The Leading Online Publisher of National and State-specific Legal Documents. ICalculator is packed with financial. Mario calculates his capital gain as follows.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. You can calculate your Monthly take home pay based of your Monthly Capital Gains Tax Calculator and. 6500 - 4000 60.

Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. Discover our tax tools today. 2021 capital gains tax calculator.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Find out your tax brackets and how much Federal and Provincial. Adjusted cost base plus outlays and expenses on disposition.

Investment decisions have tax consequences. Calculating your capital gain or loss. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. If your only capital gains or losses are those shown on information slips T3. If you sell qualifying shares of a Canadian business in 2022 the LCGE is 913630.

Long-Term Capital Gains Tax Rates. In Canada 50 of the value of any capital gains is taxable. Get Access to the Largest Online Library of Legal Forms for Any State.

Your sale price 3950- your ACB 13002650. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. Completing your tax return.

Filing Status 0 Rate 15 Rate 20 Rate. All capital gains Calculators on iCalculator are updated with the latest Federal and Provincail Tax Rates and Personal Allowances for the 202223 tax year. 2022 capital gains tax rates.

Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces. Use Schedule 3 Capital Gains or Losses to calculate and report your taxable capital gains or net capital loss. Capital assets subject to this tax include real estate land shares bonds.

A Canada Capital Gains Tax Calculator formula that will allow you to manually crunch numbers and get your rate. The sale price minus your ACB is the capital gain that youll need to pay tax. Our capital gains tax calculator can provide your tax rate for capital gains.

However as only half of the realized capital gains is taxable the deduction limit is in fact.

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

Capital Gains Tax Calculator Ey Us

Github Richardwu Capital Gains Calculator Simple Interactive Python Command Line Calculator For Capital Gains With Support For Adjusted Cost Base Acb

Capital Gains Tax Calculator For Relative Value Investing

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Canadian Tax Planning Via The Lifetime Capital Gains Exemption Lcge

![]()

What Is My Tax Rate For My Crypto Gains Cointracker

Capital Gains Harvesting In A Personal Taxable Account Physician Finance Canada

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

Daily Advice Tsi Wealth Network

How Much Tax Will I Have To Pay On Cerb Consumer Credit Counselling

Capital Gains Tax Calculator For Relative Value Investing

T657 Tax Form Calculation Of Capital Gains Deduction 2022 Turbotax Canada Tips

How To Calculate Tax Payable On The Sale Of Your Rental Properties

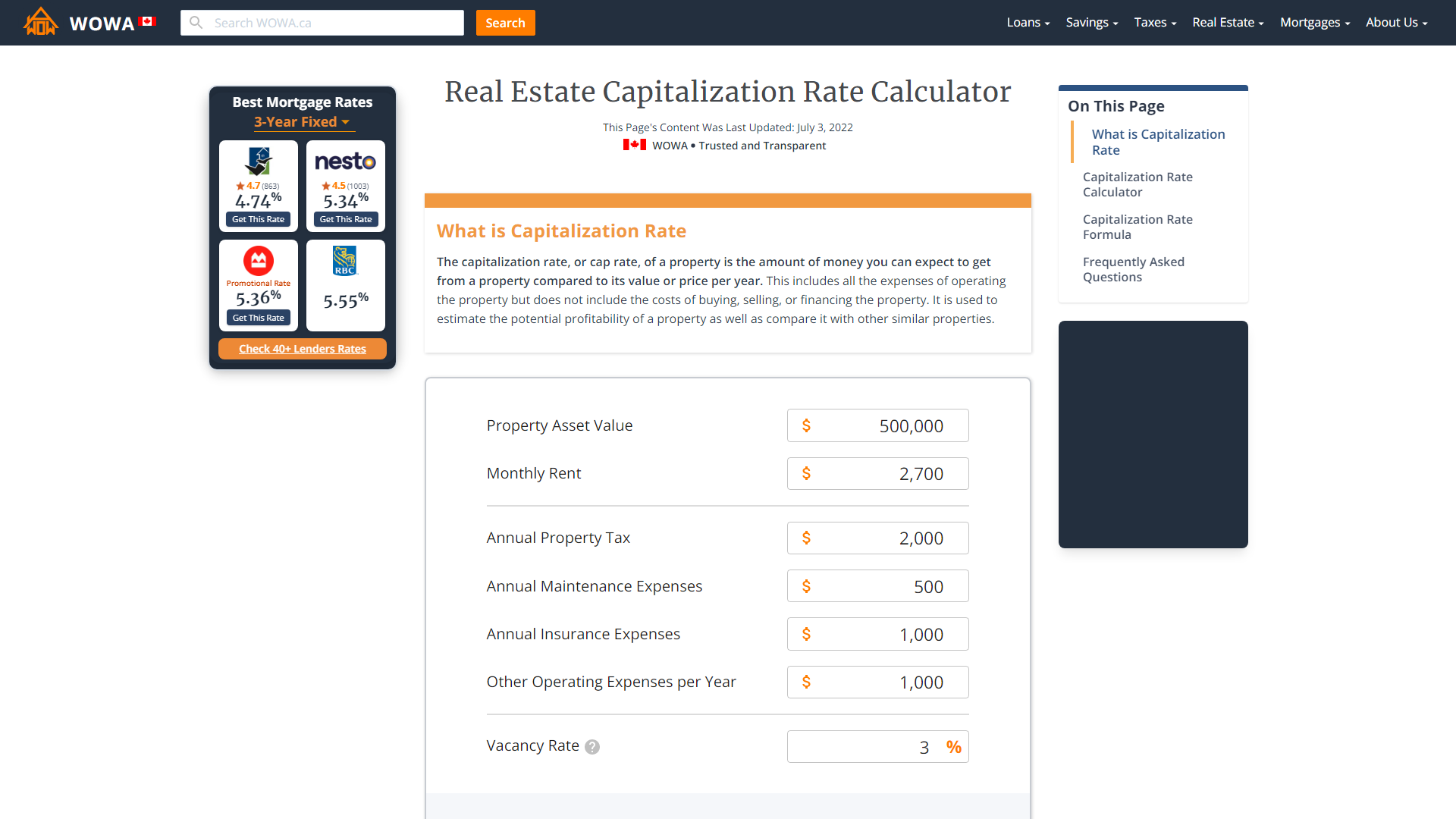

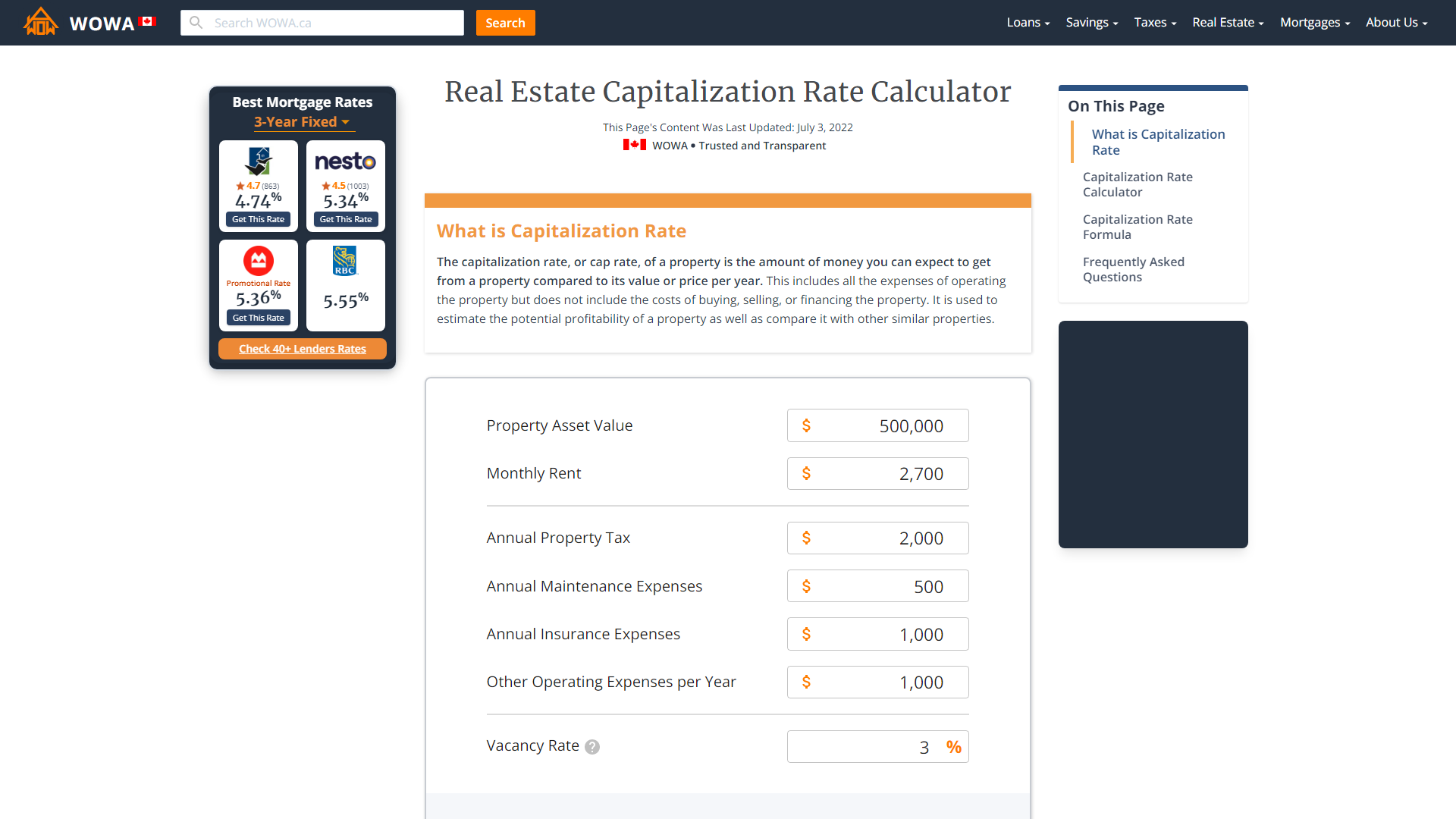

Cap Rate Calculator Formula And Faq 2022 Wowa Ca

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Grandfathering Long Term Capital Gain On Stocks Equity Mutual Funds With Calculator